Who will fund the AI Century?

Jan 8, 2026

Introduction

In 2025, OpenAI announced a $500B cluster, funded by Softbank and Oracle. But to get to the next OOM — $5T — who will they turn to for financing?

$5T is larger than the largest Sovereign Wealth Funds (e.g. Norges is ~$2.04T). AI has a financing problem.

Stablecoins are the solution; they total only ~$310 billion today, yet grew more than 80% last year.

We believe stablecoins will eat much of the $120T of global M2. Then, stablecoin issuers will need to deploy their reserves into private credit opportunities at the scale of trillions.

The US government wants this for two reasons:

To solve the AI financing scaling problem, as AI is the main source of growth in the economy.

For dollar hegemony in its own right. Other countries are quickly adopting stablecoins of their own currencies as well.

How Compute Forced a New Dollar Architecture

History rarely moves at a steady pace. Long periods of apparent stasis are often punctuated by brief intervals in which economic, political, and technological structures reorganize themselves all at once. We are living through one of those moments. Artificial intelligence is emerging as the Schelling point of such a moment, compressing decades of capital formation, policy response, and institutional change into a handful of years.

The asset prices of a small group of world-historical technology companies (SpaceX, OpenAI, Anthropic, etc.) are no longer behaving like ordinary equities. They are pricing in strategic indispensability.

Until recently, the most powerful technology companies were capital-light juggernauts. Firms like Google and Meta were so valuable because their growth was fueled by minimal capex relative to their scale; the core investor question was how many eyeballs remained to be captured, and how quickly. That calculus has now changed entirely. The dominant firms of the next era are defined by their ability to marshal capital, energy, compute, and state alignment at scale.

Artificial intelligence has become the gravitational center of this transition. With the AI boom already generating trillions of dollars in market capitalization for Nvidia and the Mag 7, a new cast of dealmakers across technology, politics, and finance is actively recrafting America’s power structure. Compute, once an input, is becoming the organizing principle.

Therefore, the electrodollar, dollar-denominated liquidity flowing through stablecoins and other tokenized channels, may ultimately be remembered as the mechanism through which modern states learned to fund strategic technologies in a post-industrial economy.

It acts as a financial bridge, linking private capital and state-backed spending to power the AI economy, creating a system capable of underwriting trillion-dollar infrastructure projects and coordinating massive capital deployments at scale.

The critical question emerges early: who is going to fund this? The scale of compute, data, and infrastructure required seems almost impossible to underwrite through traditional capital markets alone. The AI economy will go beyond simply consuming liquidity; it will force the creation of new financial structures to absorb and direct it.

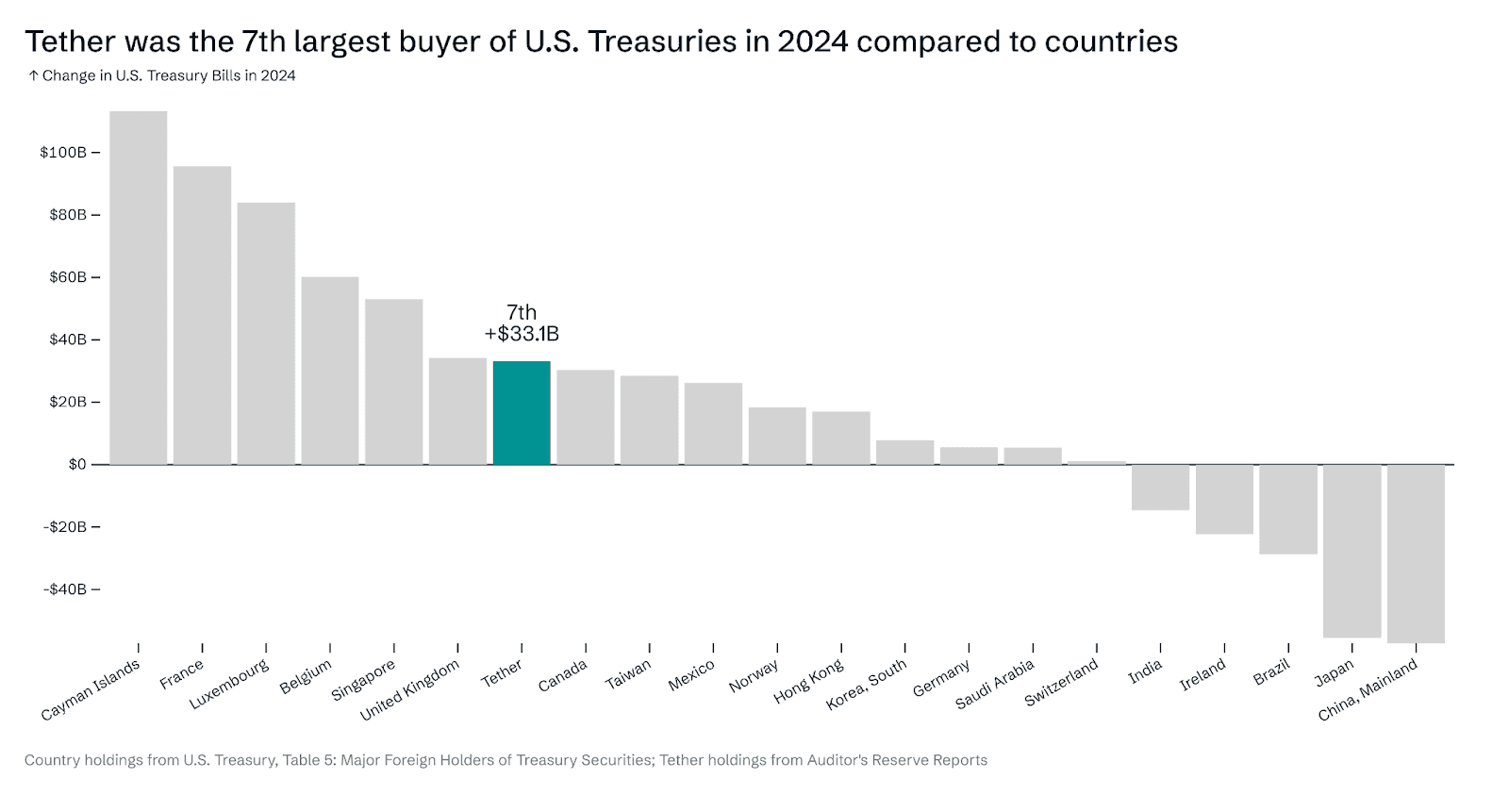

At scale, this problem is already being quietly absorbed by a new class of buyers: stablecoin issuers. Today, Tether and Circle alone rank among the largest holders of U.S. Treasuries, collectively surpassing Germany, despite having emerged only within the past decade. By supplying dollar liquidity at scale, these stablecoin issuers do more than hold Treasuries; they help synchronize the flow of capital, compute, and strategic investment, effectively underwriting the AI boom itself.

Engines that move Markets

Mustafa Suleyman, the co-founder of DeepMind, captured this dynamic succinctly in The Coming Wave:

“Declaring an arms race is no longer a conjuring act, a self-fulfilling prophecy. The prophecy has been fulfilled. It’s here, it’s happening. It is a point so obvious it doesn’t often get mentioned: there is no central authority controlling what technologies get developed, who does it, and for what purpose; technology is an orchestra with no conductor.”

In the orchestra of technology, AI is the coveted instrument – the piano or violin that draws all the attention. The die has been cast, and the world’s economy is being lurched side to side by advances in compute, Nvidia chief among them. “Everybody is counting on us,” Jensen Huang remarked a year ago, later noting that China is only “nanoseconds behind” the United States in chipmaking.

Unlike previous technology cycles, AI sits at the intersection of cultural centrality and national security. That dual framing makes it a sui generis kind of bubble – one that is not merely tolerated, but actively reinforced. Strategic importance weakens capital discipline, while geopolitical rivalry turns redundancy and excess capacity into features rather than inefficiencies.

This does not mean the investment surge is irrational. As Byrne Hobart and Tobias Huber argue in Boom, bubbles often function as coordination mechanisms rather than pure delusions:

“By generating positive feedback cycles of enthusiasm and investment, bubbles can be net beneficial… A bubble can be a collective delusion, but it can also be an expression of collective vision. That vision becomes a site of coordination for people and capital and for the parallelization of innovation. Instead of happening over time, bursts of progress happen simultaneously across different domains… The fear of missing out attracts even more participants…none of us wants to miss out on a once-in-a-lifetime chance to build the future.”

In this sense, AI behaves exactly as history would predict. The collective vision around artificial intelligence has synchronized capital, talent, and political power across multiple domains simultaneously. Data centers, semiconductor supply chains, energy infrastructure, and policy all advance at once. Progress is parallelized; innovation no longer diffuses gradually.

Past technology bubbles – those borne from railroads and electricity – also benefited from this dynamic. But none were treated as indispensable to American national security in the way AI is today. Overcapitalization in AI isn't a speculative edge case; it is the base case. Even if the strategic premise proves overstated, any pullback would be unusually disruptive, given how much new economic growth depends on AI infrastructure.

The collective vision around AI has begun to distort pricing well beyond the sector itself. Liquidity floods toward compute, and non-AI assets are increasingly crowded out – capital is inhaled from biotech, industrials, and other long-duration bets. Asset prices bend around a single gravitational center.

These dynamics unfold against an unusually hostile macro backdrop. U.S. debt growth has exceeded expectations even from a decade ago, labor’s share of the economy continues to erode, and inflation appears structurally higher for longer, leaving limited room for rate cuts. Traditional tools for managing speculative excess are constrained.

One plausible near-term outcome is that AI grows into a far larger share of the economy than currently anticipated because national security considerations compel policymakers to underwrite compute expansion at scale. In that world, demand is politically enforced, not purely market-driven.

Everyone knows this is a race the United States cannot lose. Mark Zuckerberg recently framed the problem as a Pascal’s Wager: falling behind in AI could spell existential decline for Meta, while spending billions in R&D is easily justified if AI becomes as important as expected.

Stablecoins: Financing the AI Century

At some point, the U.S. government becomes the bidder of last resort, underwriting runaway demand for compute, but someone eventually has to monetize this deficit spending. Dollar-denominated assets must find holders and so, the funding problem leads directly to stablecoins.

Historically, U.S. deficits were absorbed by foreign sovereigns – China, Japan, oil exporters recycling trade surpluses into Treasuries – which led to the creation of the petrodollar. That model is now breaking down. In its place emerges a structurally different buyer: globally distributed, digitally native dollar demand generated by AI systems, autonomous firms, and algorithmic commerce. In other words, capital will flow to the dollar because compute itself settles in dollars.

Here, stablecoins will play a crucial role:

Supply side: Minting new stablecoins generates demand for Treasuries and other dollar assets.

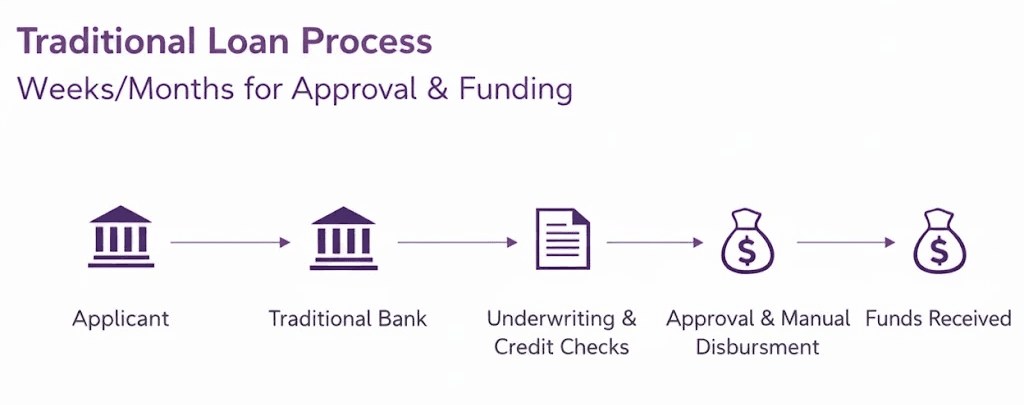

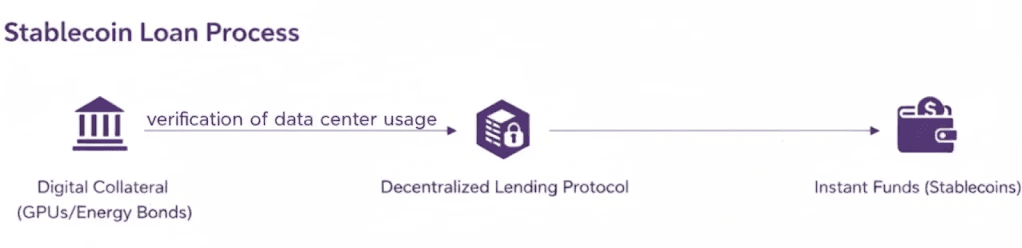

Demand side: The AI economy manufactures dollar demand. Autonomous firms and machine-driven markets move value continuously, creating a financial environment where settlement, lending, and hedging must happen in real time. Legacy systems can’t do this. They can move money, but they can’t run risk. DeFi can. Lending and derivatives, essential to energy markets and soon to AI markets, can be executed algorithmically, without human latency.

In an economy where assets themselves are created by software, financial infrastructure has to operate at the same speed. That is why lending tied to GPUs, data centers, and AI infrastructure is likely to converge on stablecoins. Stablecoin-based markets allow risk to be priced, transferred, and settled continuously – something traditional rails were never built to do.

Beyond Treasuries: That demand is not limited to government debt. Corporate bonds issued by AI-aligned firms, energy infrastructure debt, and other tokenized instruments can all serve as reliable settlement units for autonomous economic activity. These assets are attractive because they are dollar-denominated, liquid, and compatible with algorithmic and agentic transactions.

As the AI economy scales, this broader set of tokenized assets diversifies the electrodollar ecosystem, spreading systemic influence beyond Treasuries and creating multiple channels through which AI activity sustains liquidity in the financial system.

The Hum of the Electrodollar

Unlike the platform monopolies of the last era, which scaled with minimal marginal cost, today’s dominant firms are capital-intensive by design. Compute, energy, and fabrication are now the binding constraints. Financing, more than distribution, is the central economic problem of the AI age.

If stablecoin issuers become the main buyers of U.S. debt, they quietly step into enormous financial power. On paper, Treasuries may look like they’re held domestically – by banks, funds, or stablecoins – but in practice, they reflect global demand for dollars flowing through digital channels. AI and machine-driven commerce are creating a steady appetite for dollar-backed assets, turning computing power itself into a driver of currency demand.

This system carries risks. Stablecoins must stay trustworthy and liquid. If they stumble, the flow of capital to AI infrastructure could falter, slowing compute expansion and even raising national security concerns. The absence of alternatives makes the electrodollar resilient in the short run, but also dangerous in the long run. Systems that concentrate demand into a single monetary channel often overextend, leaning on weaker collateral and rising leverage to sustain growth. As we learned from the South Sea Bubble, history is clear: this dynamic can look stable for years, then collapse all at once.

In the 20th century, state power was measured in factories, armies, and industrial policy. In the 21st, it’s measured in compute, energy, and the ability to fund both at scale. History favors first movers. Just as Britain and the Netherlands once set industrial standards, countries that control AI infrastructure and its financing will hold disproportionate influence, while laggards may be forced to adapt, or fall behind.

The AI mania has exposed the limits of traditional fiscal tools, while stablecoins have revealed an unexpected extension of them. Together, they form an emergent architecture – blurring the line between public ambition and private infrastructure.

AI infrastructure (compute, energy, semiconductor supply chains) will increasingly be classified as critical national infrastructure. The state becomes guarantor, anchor customer, and insurer of last resort.

The open question is not whether AI will justify today’s valuations, nor whether stablecoins will continue to grow.

It is whether the financial structures forming around both can absorb their success without destabilizing the broader economy.

For now, the incentives remain aligned: compute must be built, debt must be financed, and dollars must find holders. How long that alignment persists may determine whether this era is remembered as a coordinated leap forward, or as the moment financial gravity finally caught up with technological ambition.